Ytd federal withholding calculator

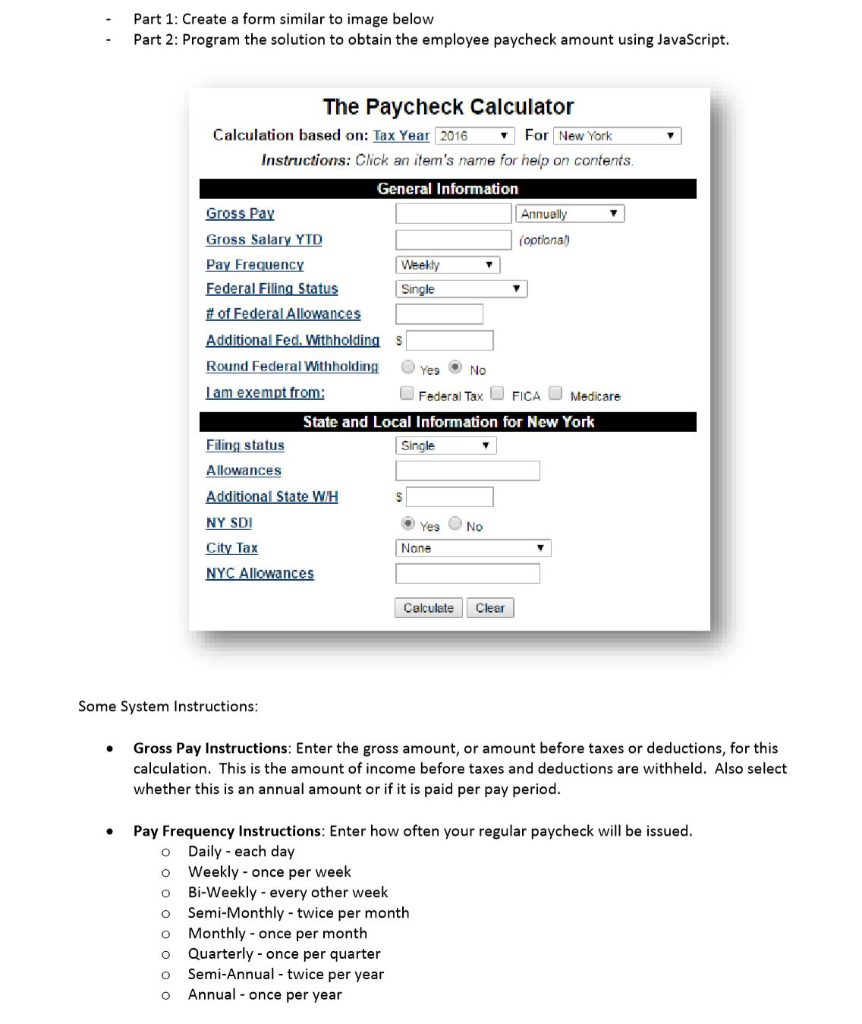

The impact on your paycheck might be less than you think. Federal Filing Status of Federal Allowances.

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

Switch to Oklahoma hourly calculator.

. Pay Frequency Use 2020 W4. Free Federal and New York Paycheck Withholding Calculator. This tech very helpful and had me download the IRS calculator excel worksheet.

Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit. Payroll Deductions Online Calculator. If you have a household with two jobs and both pay about the same click.

While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding. Common deductions include federal tax state tax Medicare and social security. Check out the IRS withholding calculator.

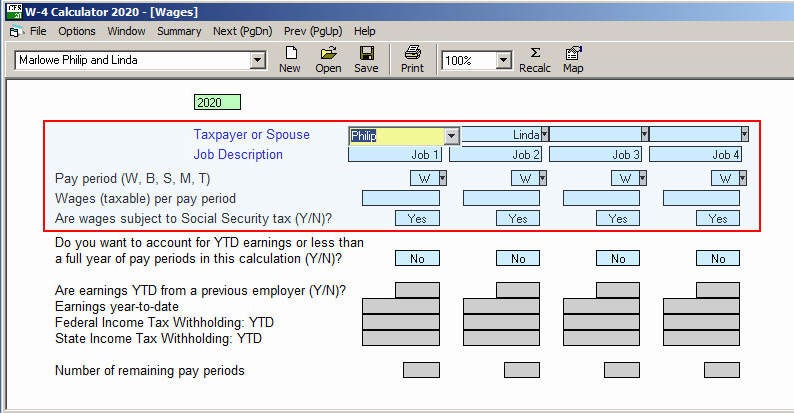

On March 3 2022 the Governor General in Council on the recommendation of the Minister of National Revenue made amendments to Subsection 100 3. 401k403b plan withholding This is the percent of your gross income you put into a taxable deferred retirement account such as a 401k or 403b. Switch to Washington hourly calculator.

And the formulas in this guide for withholding starting with your first payroll in July 2022. The stub must provide both an itemized list of deducted amounts and the sum of all deductions. 2022 W-4 Help for Sections 2 3 and 4.

If you have a household with two jobs and both pay about the same click. The federal withholding taxes are not calculating for some of our employees. Upcoming Guidance for January 2023 and January 2024 Editions.

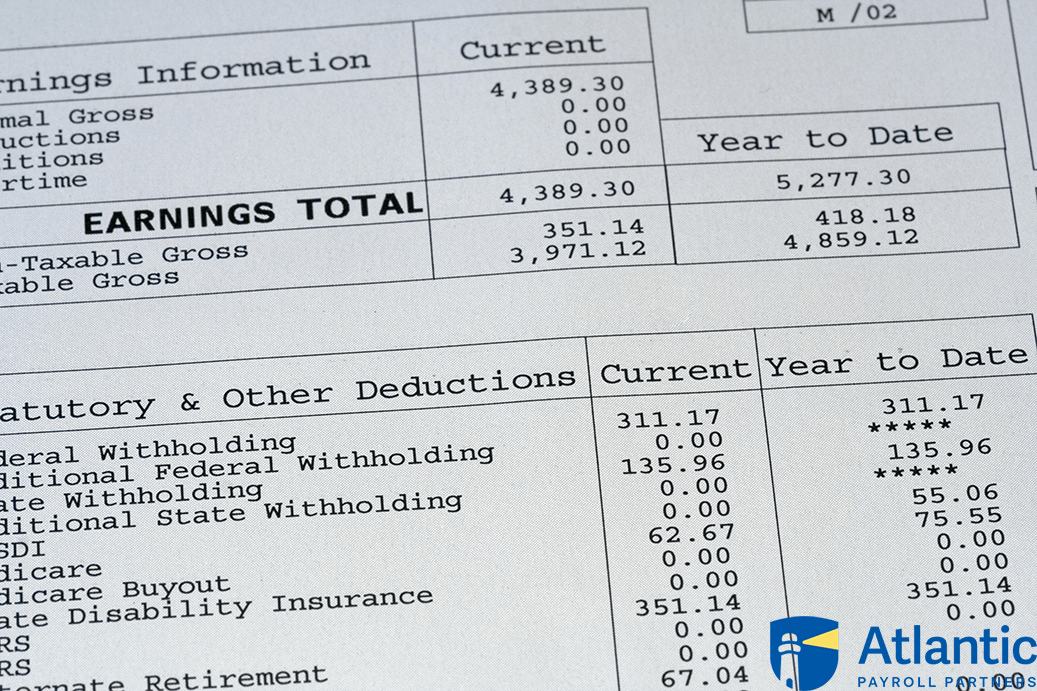

A pay stub should also list deductions for both this pay period and the YTD. Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma paycheck calculator. 2022 W-4 Help for Sections 2 3 and 4.

Exempt from Federal. Until they decide to change the math formula to look at YTD Total Gross Wages for each paycheck. Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit.

0 Cheer Reply Join the conversation. They are all using the 2020 W-4 form. Free Federal and Illinois Paycheck Withholding Calculator.

Payroll Taxes Aren T Being Calculated Using Ira Deduction

How Do You Get Info Back On Pay Stubs Withholding Status And Allowances Extras No Longer Show On Paystub

What Does Ytd On A Paycheck Mean Quora

How To Calculate Net Pay Atlantic Payroll Partners

Filing Status Instructions Select Your Filing Chegg Com

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Online For Per Pay Period Create W 4

Us Enter Year To Date Ytd And Current Amounts Wagepoint

Tax Information Career Training Usa Interexchange

Payroll Calculator Free Employee Payroll Template For Excel

Decoding Your Paystub In 2022 Entertainment Partners

Payroll Calculator Free Employee Payroll Template For Excel

Hrpaych Yeartodate Payroll Services Washington State University

How To Calculate Payroll Taxes Methods Examples More

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

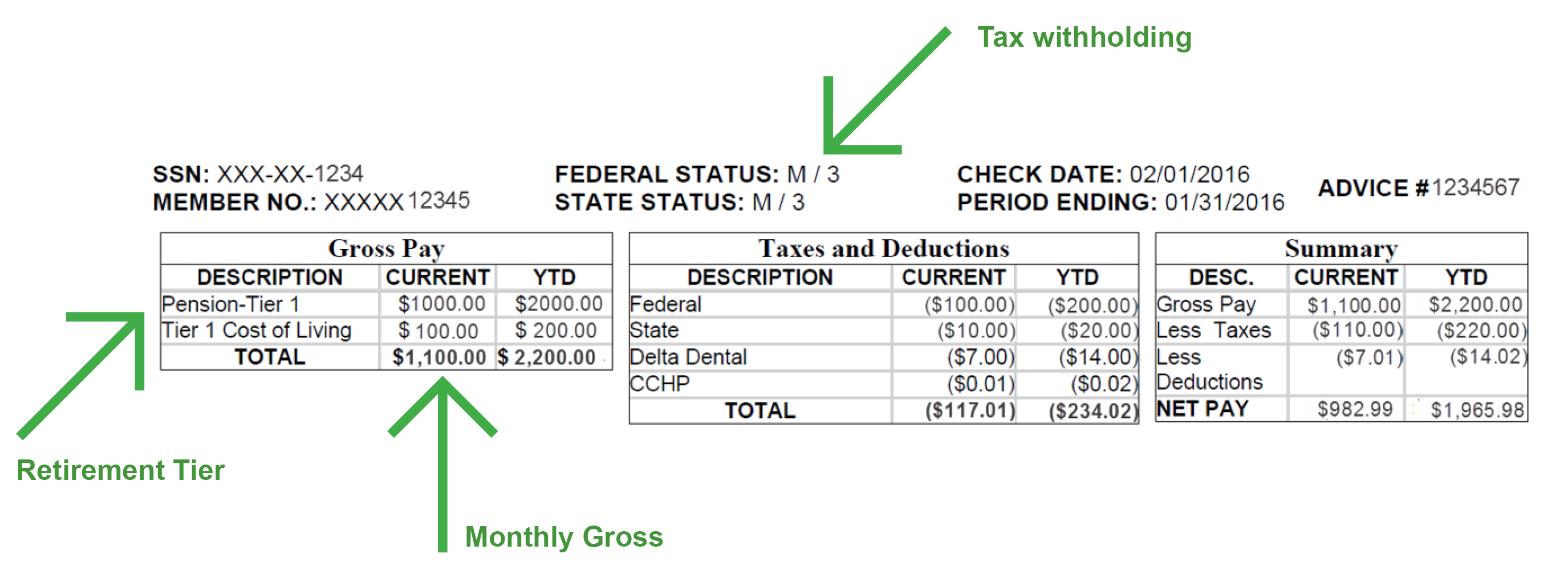

Benefit Advice Notice Contra Costa County Employees Retirement Association

W 4 Calculator Cfs Tax Software Inc